Mortgage Calculators

Unlock Better Home Loan Financing

Whether you're buying a home, refinancing, or selling, our mortgage calculators can help you make better financing decisions.

Explore Home Loans

Calculator Disclaimer

| Término | Tasas desde | APR* "As Low As" | Ejemplo de cantidad del préstamo | Ejemplo de pago mensual |

|---|---|---|---|---|

| 10 Años - Purchase or Refi | 6.250% | 6.530% | $200,000 | $2,245.60 |

| 15 Años - Purchase | 6.375% | 6.574% | $200,000 | $1,728.50 |

| 15 Años - Refinanciamiento | 6.500% | 6.700% | $200,000 | $1,742.21 |

| 20 Años - Purchase or Refi | 6.875% | 7.037% | $200,000 | $1,535.63 |

| 30 Años - Purchase | 6.875% | 6.999% | $200,000 | $1,313.86 |

| 30 Años - Refinanciamiento | 7.000% | 7.125% | $200,000 | $1,330.60 |

Los pagos mensuales de ejemplo no incluyen impuestos ni seguro; la obligación de pago real será mayor.

HOME LOANS: Rates based on creditworthiness. Mortgage loans are originated by Space Coast Credit Union and are subject to credit approval, verification, and collateral evaluation. Programs, offers, rates, terms, and conditions are subject to change or cancellation without notice. Certain restrictions apply. Taxes and insurance not included; your actual payment obligation will be higher.

These mortgage loan programs constitute first mortgage liens secured by the home and property. Your down payment is determined by the Loan-to-Value ratio. (90% LTV = 10% down payment). Loans exceeding 80% of the appraised value of the home require private mortgage insurance. Member responsible for any funds needed for closing costs (unless member attached a No Closing Costs option to loan) and pre-paid escrow.

Additional Home Loan Resources

About These Home Loan Calculators

When considering financing for a new home, it's important to consider factors such as down payment amount, home purchase price, closing costs, qualifications, home loan type, interest rate, and terms, to name a few. Our calculators can help determine those amounts and more!

Calculate a Mortgage Payment Calculator

If you’d like to get an idea of what your monthly mortgage payment would be, our “Calculate a Mortgage Payment” calculator is the right tool for you. Simply enter your prospective home’s price, the down payment that you can reasonably afford, annual property taxes, monthly HOA fees (if any), annual home insurance premiums, loan term, and interest rate. You’ll then get a breakdown of your monthly payment along with loan payoff information in chart, table, and amortization form.

You can compare two different down payment amounts to see the impact it would have on your monthly payments, private mortgage insurance (PMI) amount, and difference in savings with our “Down Payment Calculator.” Learn more about SCCU’s No Down Payment Home Loan Option.

Loan Amount Calculator

Alternatively, if you have a monthly mortgage payment and down payment amount in mind that will work best for you, our “Loan Amount Calculator” will help you determine the maximum loan amount you can afford within those parameters. This calculator can also take into account monthly home insurance premiums, monthly property taxes, and monthly HOA dues.

Rent or Buy? Calculator

You might be wondering if renting or buying a house is better for you, especially as housing markets differ in certain areas over time. First, fill in the information under rental assumptions and purchase assumptions. Under “Other Assumptions,” you can leave the fields as they are, or research the averages for a more accurate estimation. Then, the calculator will let you know if you could be saving more with renting or buying. The results may surprise you!

Note: FHA Loans may be an ideal option for you if you’re buying a home for the first time or if you’re still working on building or improving your credit.

Home Affordability Mortgage Calculator

Lenders determine the maximum home loan amount you’d qualify for based on your creditworthiness and these three ratios:

- Loan-to-value ratio (LTV): This is the ratio of the loan amount to the home’s value. With a 20% down payment, this is an 80% LTV. Our “Loan Amount Calculator” can help you determine your LTV.

- Housing ratio: This is the percentage of a borrower’s total income that will go towards housing expenses. Ideally, no more than 28% of your monthly gross income should go towards mortgage payments.

- Debt-to-income ratio (DTI): This ratio considers all monthly debt payments, including housing expenses, as a percentage of the borrower’s total income. In most cases, lenders allow a DTI up to 43%. Find out your DTI with the “Debt-to-Income Calculator.”

The “Home Affordability” calculator will estimate the maximum purchase price based on each of these three factors and the most limiting of the three ratios.

Compare Two Mortgage Loans

Whether you’re looking to compare two types of home loans or loan offerings at two different institutions, the “Compare Two Mortgage Loans” calculator will show you which one will cost you more. Although the interest rate you’ll pay on a mortgage provides the biggest impact on your loan, other costs matter too. These include origination charges, settlement costs, and fees that a borrower pays (“points”) to get a certain interest rate.

Calculate Home Closing Costs

When buying a home, closing costs are almost inevitable (but sometimes negotiable). After entering the amounts for purchase price, down payment percentage, origination fees, and settlement services, you’ll be able to get an idea of what the total amount of those costs will be with this calculator.

Did you know that with our No Closing Costs Home Loan option, we’ll cover your typical closing costs and waive the origination fee, which significantly lowers the money you’ll need to pay up front? Keep in mind that you’ll need a down payment and prepaid property taxes, homeowners insurance, and interest.

Adjustable-Rate Mortgage Analyzer

Adjustable-rate mortgages usually offer homebuyers a lower interest rate during the initial loan period, and the rate will increase or decrease at certain intervals, with minimum and maximum interest rate allowances. At SCCU, you’ll also have the ability to convert an adjustable-rate mortgage to a conventional fixed-rate loan. Learn how an adjustable-rate mortgage works works here.

Using our “Adjustable Rate Mortgage Analyzer” calculator allows you to see the impact choosing this loan type would have on your principal and interest payment under a variety of scenarios. An SCCU Team Member will also be happy to help you navigate this calculator’s inputs and walk you through the pros and cons of adjustable-rate mortgages.

Additional Mortgage Calculators

Are you a current homeowner not planning on moving any time soon? These calculators may be of interest to you:

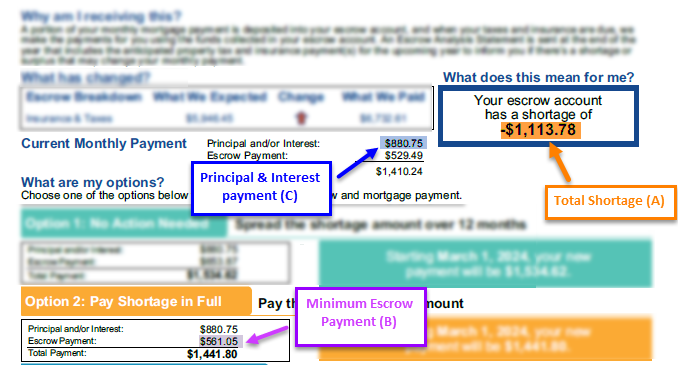

- Partial Escrow Shortage Payment Calculator: If you’d like to make a partial escrow payment up front because of a shortage, but you’re not sure how much you want to pay up front or how it’ll affect your monthly mortgage payment, this one can help!

- Compare a Bi-Weekly Mortgage to a Monthly Mortgage: See how much faster you’ll pay off your mortgage and how much interest you’d save by making mortgage payments every other week (26 times a year) versus monthly (12 times a year) with this calculator!

- Time to Refinance?: Many times, borrowers who are interested in refinancing would like to get a lower rate and payment; other times, they’d like a faster loan payoff or cash back to make a big purchase. But, sometimes the closing costs could outweigh the potential savings. SCCU also offers a mortgage refinancing option.

When you are looking to sell your home, our “Proceeds from Sale of a Home” calculator can help you get an idea of how much money you’ll yield upon the sale of your home.

Additional Home Loan Options

SCCU offers a variety of additional home loan options to fit your needs:

- Construction-to-Permanent Loans: The best part? You’ll only have one set of documents and one set of closing costs. During the home construction process, we’ll draw loan funds at certain milestones to pay your builder. Upon completion, we’ll convert your construction loan to a permanent loan.

- Condo Loans: Getting condo financing isn’t always straightforward, but our experienced loan officers can guide you through HOA and owner-occupancy rules to help you get into your new place sooner.

- Jumbo Home Loans: Properties with higher valuations come with special considerations when financing. You can turn your dream into a reality with our Jumbo Home Loans that suit large loans.

- Hero Loans: To honor frontline workers, SCCU offers exclusive home loan options specifically for first responders, law enforcement, medical professionals, educators, military personnel, and Department of Defense and government contractors.

- VA Loans: These are available for active service members and veterans with up to 100% loan-to-value financing on purchases.66

Frequently Asked Questions

Banks and credit unions set their mortgage rates based on the current national index. Rates fluctuate by what’s going on with the general U.S. economy. Credit unions typically offer lower rates and fees than banks because credit unions are not-for-profit institutions that exist to benefit their members, not shareholders.

SCCU offers mortgage calculators that make it easy to calculate your payment and make comparisons to help you in your decision-making process. They use the initial balance, the interest rate, and the term to calculate what payment will be needed to have the amount paid off in full in the agreed upon term.

You can always find SCCU’s current mortgage rates here.

With a mortgage through SCCU, you’ll benefit from competitive credit union mortgage loan rates and lower fees with flexible terms. Plus, we offer fast pre-qualification decisions, no intangible tax21, an interest rate guarantee18, electronic closing options, and personalized service throughout the life of the loan. You can apply for a mortgage loan online here. If you have any questions, feel free to fill out this form or reach out to us here.

The information provided by these calculators is intended for illustrative purposes only and is not intended to represent actual user-defined parameters. The default figures shown are hypothetical and may not be applicable to your individual situation. Be sure to consult a financial professional prior to relying on the results.